Advascale’s Client is a financial technology (fintech) company that offers bitcoin and other cryptocurrency exchange services and a trading automation platform. They had an “on-premises over cloud” infrastructure with many difficulties. Advascale successfully migrated the company’s system to the new cloud infrastructure.

Cloud infrastructure was struggling with scaling.

Making the application (including proxies) in AWS scalable and fault-tolerant was essential. It was necessary to avoid the restriction on the number of requests per IP per second. At the same time, the IPs must be whitelisted. Also, it was essential to move the current backend on Autoscaling. The client had his infrastructure in AWS, but it wasn’t configured correctly.

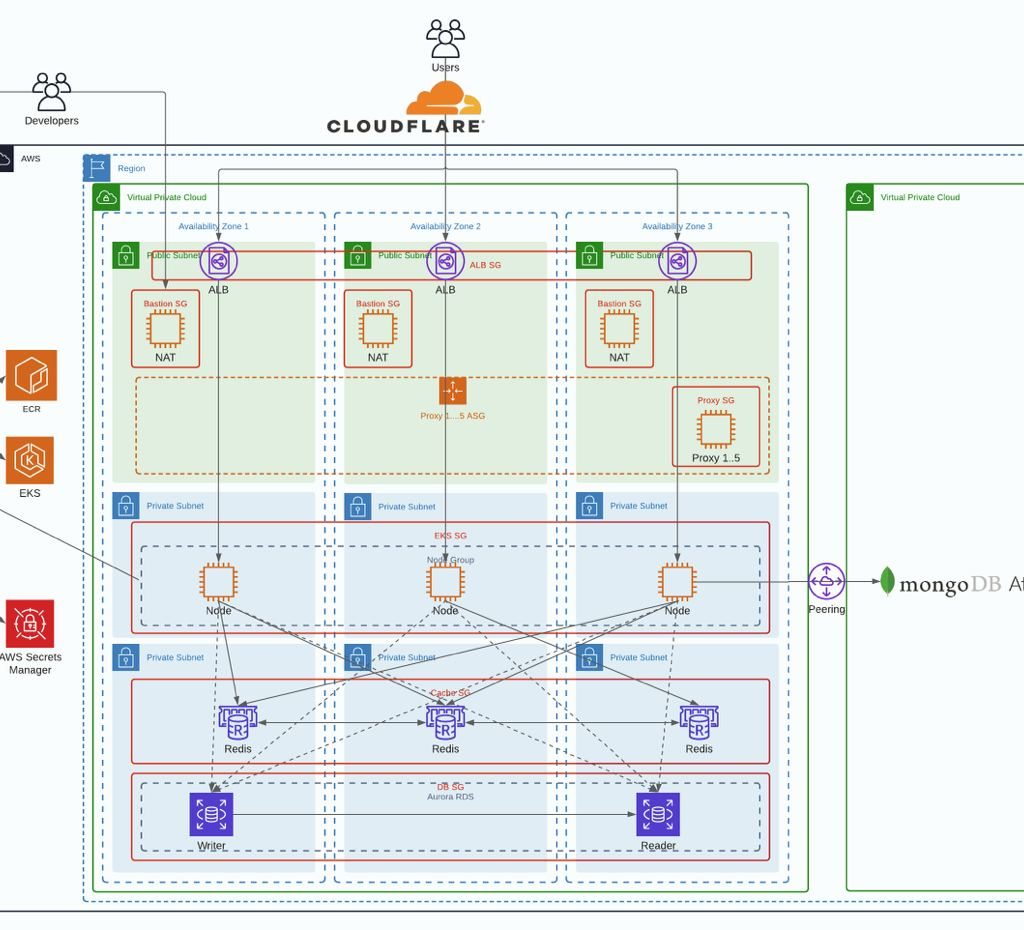

Application environments will be deployed across two VPCs with three availability zones. One for production, one for staging application stack.

The application, which consists of two parts, “php+nginx”, and “node”, will be deployed in the Kubernetes cluster. For database will be used MongoDB Atlas – a Cloud DBaaS for MongoDB, with connection via VPC peering and Aurora SQL for MySQL.

As a session handler and cache will be used Redis replica set with enabled multi-az and auto-failover functionality.

Proxies will be implemented as an autoscaling group, with one instance with EIP association, and based on AMI with installed docker.

Advascale successfully migrated the company’s system to the new infrastructure, receiving positive feedback from the Client.

The new infrastructure makes scaling simple with recommendations that allow the Client to optimize performance, costs, or balance between them.

The availability of solutions has risen to 99.965 percent.

The initial “cold“ infrastructure was calculated by AWS Pricing Calculator, then we made a load testing on it and calculated the loaded size.